| CAC 40 | Perf Jour | Perf Ytd |

|---|---|---|

| 7940.14 | -0.55% | -2.53% |

| Pour en savoir plus, cliquez sur un fonds | |

| Pictet TR - Atlas Titan | 4.11% |

| Pictet TR - Sirius | 3.50% |

| Candriam Absolute Return Equity Market Neutral | 3.14% |

| JPMorgan Funds - Europe Equity Absolute Alpha | 2.46% |

| RAM European Market Neutral Equities | 2.14% |

| Pictet TR - Atlas | 2.12% |

| Sapienta Absolu | 1.15% |

Syquant Capital - Helium Selection

|

0.71% |

BDL Durandal

|

0.63% |

| Cigogne UCITS Credit Opportunities | 0.57% |

| Schelcher Optimal Income | 0.53% |

DNCA Invest Alpha Bonds

|

0.52% |

| H2O Adagio | 0.48% |

| Candriam Bonds Credit Alpha | 0.43% |

| ELEVA Global Bonds Opportunities | 0.18% |

| Alken Fund Absolute Return Europe | 0.18% |

| AXA WF Euro Credit Total Return | -0.32% |

| Sienna Performance Absolue Défensif | -0.33% |

| BNP Paribas Global Absolute Return Bond | -0.38% |

| ELEVA Absolute Return Dynamic | -0.92% |

| Jupiter Merian Global Equity Absolute Return | -1.19% |

Exane Pleiade

|

-3.12% |

| Fidelity Absolute Return Global Equity Fund | -4.29% |

| MacroSphere Global Fund | -5.33% |

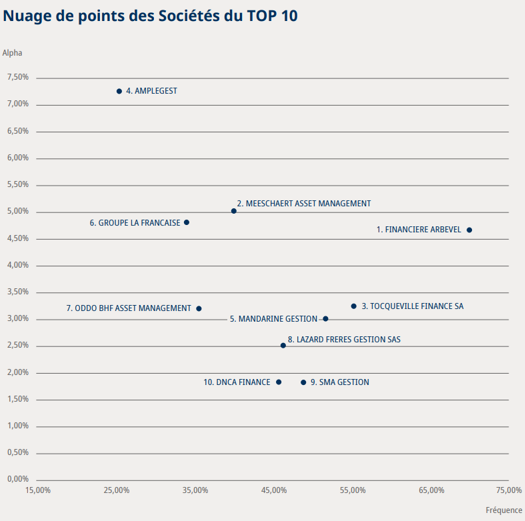

Le Top des sociétés de gestion qui génèrent le plus d'Alpha…

| Rang | Société de Gestion |

Evolution depuis 2021 |

| 1 | Financière Arbevel | Entrée 🆕 |

| 2 | Meeschaert AM | -1 ⬇ |

| 3 | Tocqueville Finance | -1 ⬇ |

| 4 | Amplegest | Entrée 🆕 |

| 5 | Mandarine Gestion | +4 ⬆ |

| 6 | Groupe La Française | - ➡ |

| 7 | ODDO BHF AM | +3 ⬆ |

| 8 | Lazard Frères Gestion | -1 ⬇ |

| 9 | SMA Gestion | -4 ⬇ |

| 10 | DNCA Finance | +10 ⬆ |

| 11 | Crédit Mutuel AM | +2 ⬆ |

| 12 | Uzès Gestion | Entrée 🆕 |

| 13 | Comgest | -10 ⬇ |

| 14 | Groupama AM | +8 ⬆ |

| 15 | Ecofi Investissements | Entrée 🆕 |

| 16 | OFI Invest AM | -8 ⬇ |

| 17 | Saint Olive Gestion | Entrée 🆕 |

| 18 | Edmond de Rothschild AM | -1 ⬇ |

| 19 | HSBC Global AM | -1 ⬇ |

| 20 | Axa IM | -5 ⬇ |

| 21 | La Banque Postale AM | -10 ⬇ |

| 22 | Covéa Finance | -1 ⬇ |

| 23 | Palatine AM | -11 ⬇ |

| 24 | Dubly Transatlantique Gestion | - ➡ |

| 25 | Cholet Dupont AM | -2 ⬇ |

Ils sortent du Top 25 en 2023 : BNP Paribas AM (27ème), La Financière de l'Echiquier (28ème), Rothschild & Co AM Europe (29ème), Amundi (32ème)

Article rédigé par H24 Finance. Tous droits réservés.

Faut-il s'inquiéter de la volatilité sur les marchés obligataires ?

Dans le "Graphique de la Semaine", l'équipe H24 sélectionne un graphique percutant proposé par un acteur du marché.

Publié le 13 mars 2026

Quelques fonds pour DORMIR tranquille...

H24 a trouvé quelques fonds capables de laisser les investisseurs dormir sur leurs deux oreilles.

Publié le 13 mars 2026

Publié le 13 mars 2026

Buzz H24

| Pour en savoir plus, cliquez sur un fonds | |

| M Climate Solutions | 6.53% |

| Regnan Sustainable Water & Waste | 4.12% |

| Echiquier Positive Impact Europe | 1.45% |

| Dorval European Climate Initiative | 1.26% |

| Storebrand Global Solutions | 1.06% |

| Triodos Impact Mixed | -0.38% |

| Triodos Global Equities Impact | -0.51% |

| EdR SICAV Euro Sustainable Equity | -0.59% |

| La Française Credit Innovation | -0.78% |

| BDL Transitions Megatrends | -1.04% |

Palatine Europe Sustainable Employment

|

-1.69% |

| Ecofi Smart Transition | -2.35% |

| Triodos Future Generations | -2.78% |

| DNCA Invest Sustain Semperosa | -3.12% |

| R-co 4Change Net Zero Equity Euro | -3.99% |